nj payroll tax calculator 2020

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Employer Requirement to Notify Employees of Earned Income Tax Credit.

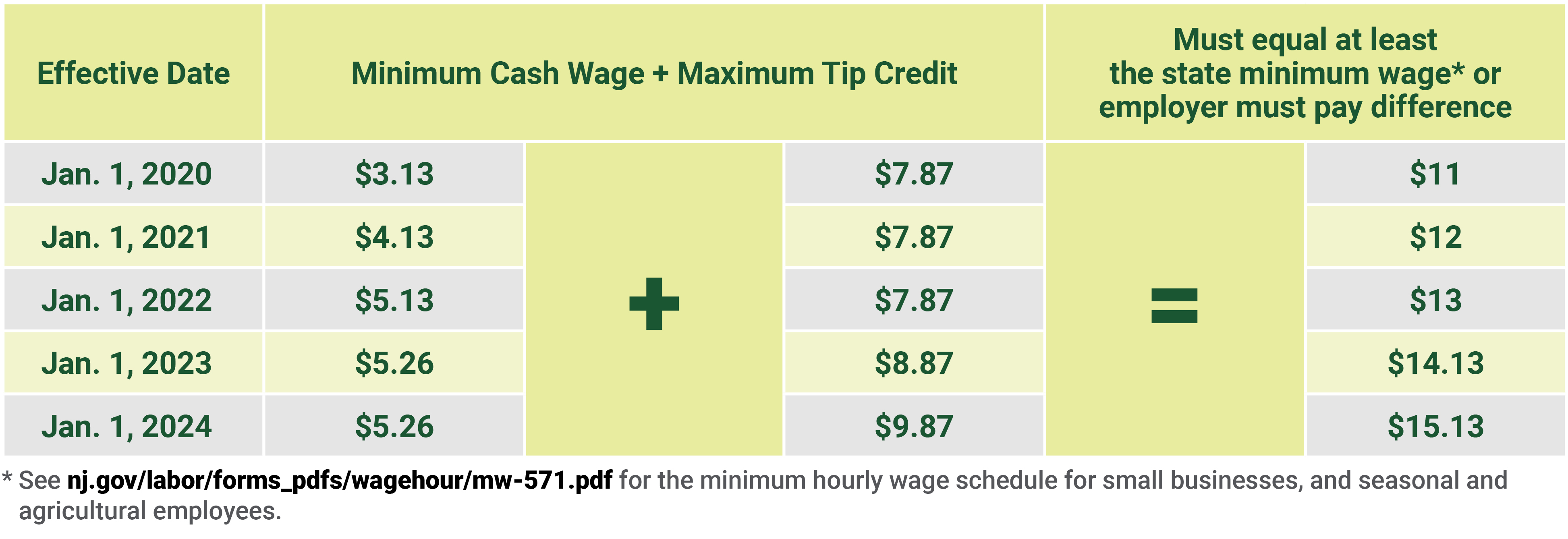

Department Of Labor And Workforce Development Tipped Workers In Nj Rights And Protections

Determine Your 2020 Shared Responsibility Payment.

. Both employers and employees contribute. PANJ Reciprocal Income Tax Agreement. The effective rate per hour for 2020 is 1100 effective 01012020.

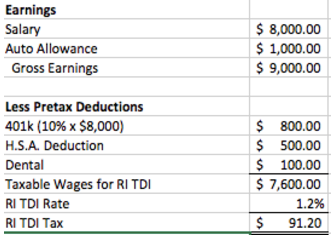

Supports hourly salary income and multiple pay frequencies. New Jersey Paycheck Calculator Calculate your take home pay after federal New Jersey taxes Updated for 2022 tax year on Aug 02 2022. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Just enter the wages tax withholdings and other information required. Free for personal use. Commuter Transportation Benefit Limits.

Click to read more on New Jerseys minimum wage increase. New Jersey new hire online reporting. Fill out this form completely if your family did not have health insurance for all or part of 2020.

PANJ Reciprocal Income Tax Agreement. This free easy to use payroll calculator will calculate your take home pay. If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783.

To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. New Hire Operations Center. New Jersey New Hire Reporting.

New Jersey Minimum Wage. 026 for calendar year. After a few seconds you will be provided with a full breakdown.

The maximum an employee will pay in 2022 is 911400. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Free for personal use.

Your average tax rate is 1198 and your marginal tax. Unemployment Insurance UI. In New Jersey unemployment taxes are a team effort.

Commuter Transportation Benefit Limits. Employer Requirement to Notify Employees of Earned Income Tax Credit. Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

New Jersey Income Tax Calculator 2021. Rates range from 05 to 58 on the first. The information provided by the paycheck calculator provides general information regarding the calculation of taxes on wages for new jersey residents only.

The new law increases the Gross Income Tax rate for income between 1 million and 5 million and provides a new withholding rate for the remainder of 2020. Under fica you also.

3 Tips To Help Small Business Owners Calculate Payroll Taxes Small Business Blog Hiscox

Paycheck Tax Withholding Calculator For W 4 Tax Planning

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

2021 Pennsylvania Payroll Tax Rates Abacus Payroll

Nj Division Of Taxation 2017 Income Tax Changes

New Jersey Nj Tax Rate H R Block

Trump S Proposed Payroll Tax Elimination Itep

Small Business Payroll Taxes How To Calculate And How To Withhold Netsuite

![]()

New Jersey Paycheck Calculator 2022 With Income Tax Brackets Investomatica

How To Start An Llc In New Jersey Step By Step Nextadvisor With Time

Njbia 2020 Business Climate Analysis Shows Nj Remains Worst In Region Njbia

Llc Tax Calculator Definitive Small Business Tax Estimator

Trump S Proposed Payroll Tax Elimination Itep

How Are State Disability Insurance Sdi Payroll Taxes Calculated

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog