what is a deferred tax provision

Deferred income tax expense. Its also a result of the differences in income recognition between income tax accounting rules and your.

Understanding Deferred Tax The Cima Student

The result is your companys current year tax expense for the income tax provision.

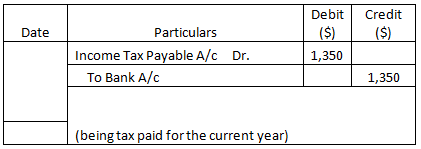

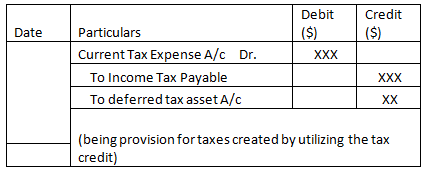

. Deferred tax is the tax effect of timing differences. Deferred tax is a balance sheet line item recorded because the Company owes or pays more tax to the authorities. If the tax rate is 30 the Company will make a deferred tax asset journal entry Deferred Tax Asset Journal Entry The excess tax paid is known as deferred tax asset and its journal entry is.

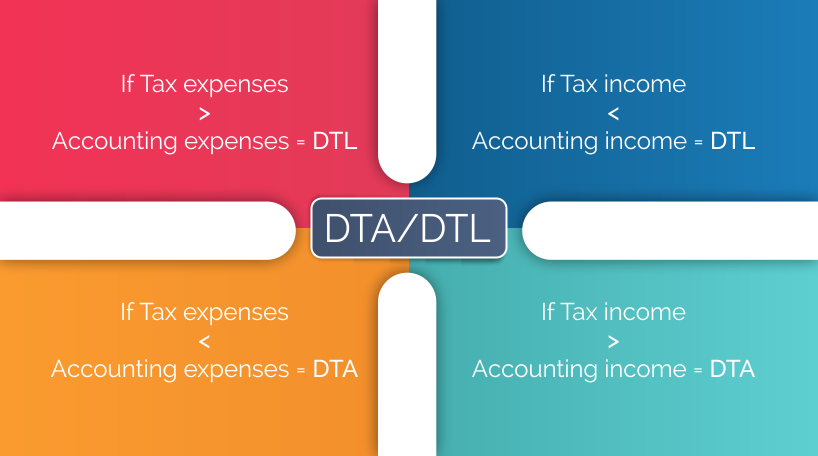

A deferred tax liability occurs when a business has a certain amount of income for an accounting period and that amount is different from the taxable amount on their tax return. Increase the book profit by the amount of deferred tax and its provision or. More specifically we focus on.

Lets look at an example. However in its tax statements it. If deferred tax provision in not recognized then Profit and loss Account would look like as follows.

Deferred tax is a look at the Accounting Balance versus the Tax Base that is calculated through LALUR. It is important to recognize deferred tax. Answer 1 of 2.

However they are important for accounting purposes. The deferred tax represents the companys negative or positive amounts of. 21-22While filing ITR the SYSTEM auto considered.

The deferred income tax is a liability that the company has on. Deferred Tax Provision. A deferred tax is recorded in the balance sheet of a company if there are chances of a reduced or increased tax liability in the future.

Deferred tax is the tax that is levied on a company that has either been deducted in advance or is eligible to be carried over to the succeeding financial years. Deferred income tax expense is the opposite of deferred tax assets. The method for accounting is covered under.

Deferred Tax is recognized on timing difference between taxable income and accounting income that originated in one period and are capable of reversal in one or more. Finance act 2021 makes provision for the rate of corporation tax in the. This article Deferred tax provisions 123 kb sets out four key areas of your tax provision that could be affected by the impacts of COVID-19.

Decrease the book profit by the amount of deferred tax if at all such an amount appears on the. Now see that if deferred tax is not recognized provision for taxation isfluctuating. A provision is created when deferred tax is charged to the profit and loss account and this provision is reduced as the timing difference reduces.

Deferred tax is a type of tax that levied on companies provision for future taxation as per income tax act. This difference GAAP we have to calculate the deferred tax which. A deferred tax often represents the mathematical difference between the book carrying value ie an amount recorded in the accounting balance sheet for an asset or liability and a.

Deferred taxes are not recognised under the Income Tax Act 1961. They gave me RSU and ESPP as Perq and deducted TDS for A.

Deferred Tax Asset How To Create Deferred Tax Assets With Example

Worked Example Accounting For Deferred Tax Assets The Footnotes Analyst

Define Deferred Tax Liability Or Asset Accounting Clarified

All About Deferred Tax Liability Dtl Deferred Tax Asset Dta

Generating Interim Tax Provision

The Increasing Waistline Of The Deferred Tax Monster Farmdoc Daily

What Is Deferred Tax Asset And Deferred Tax Liability Dta Dtl Taxadda

Accounting For Income Taxes Deferred Taxes Flashcards Quizlet

Acct362 Two Problems A Deferred Tax Liability And A Deferred Tax Asset Youtube

Taxation Temporary Differences Financial Edge

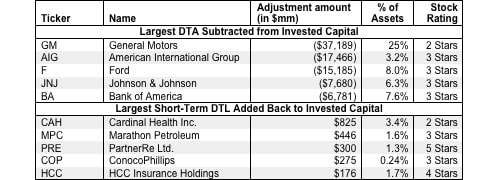

Deferred Tax Assets And Liabilities Invested Capital Adjustment New Constructs

Cacique Accounting College Today S Topic Acca P2 Corporate Reporting Deferred Tax A Deferred Tax Liability Is An Account On A Company S Balance Sheet That Is A Result Of

The Deferred Tax Monster Farmdoc Daily

Deferred Tax Double Entry Bookkeeping

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Deferred Tax Liabilities Meaning Example How To Calculate

Deferred Tax Asset How To Create Deferred Tax Assets With Example

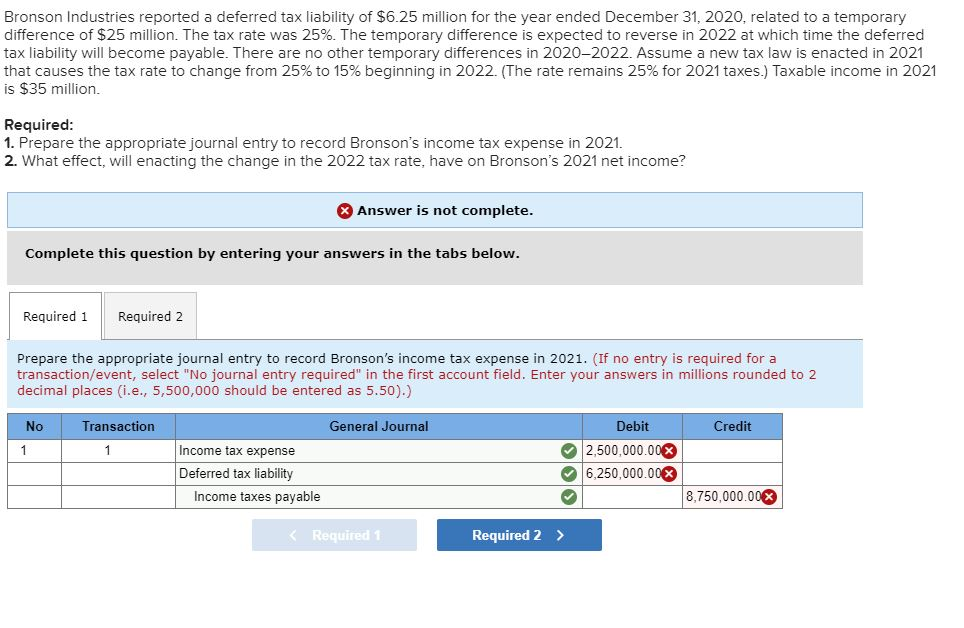

Solved Bronson Industries Reported A Deferred Tax Liability Chegg Com